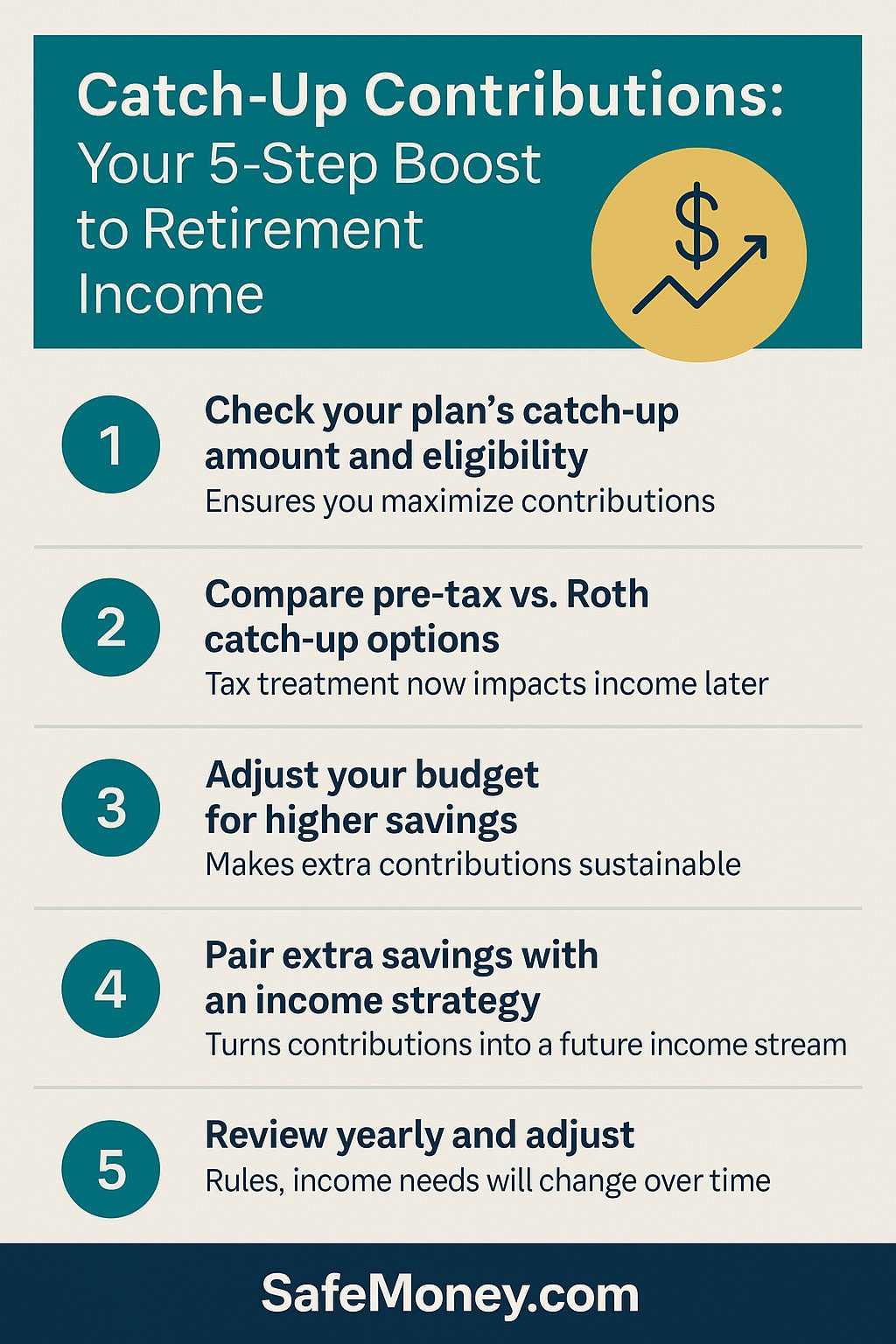

How to Use Catch-Up Contributions to Boost Your Retirement

Why Catch-Up Contributions Matter More Than Ever If you’re age 50 or older, the ability to make catch-up contributions can provide a powerful boost...

Why Retirement Financial Literacy Matters More Than Ever

The New Retirement Reality: Knowledge Is Your Strongest Asset Retirement used to mean a pension, a gold watch, and a predictable income. But...

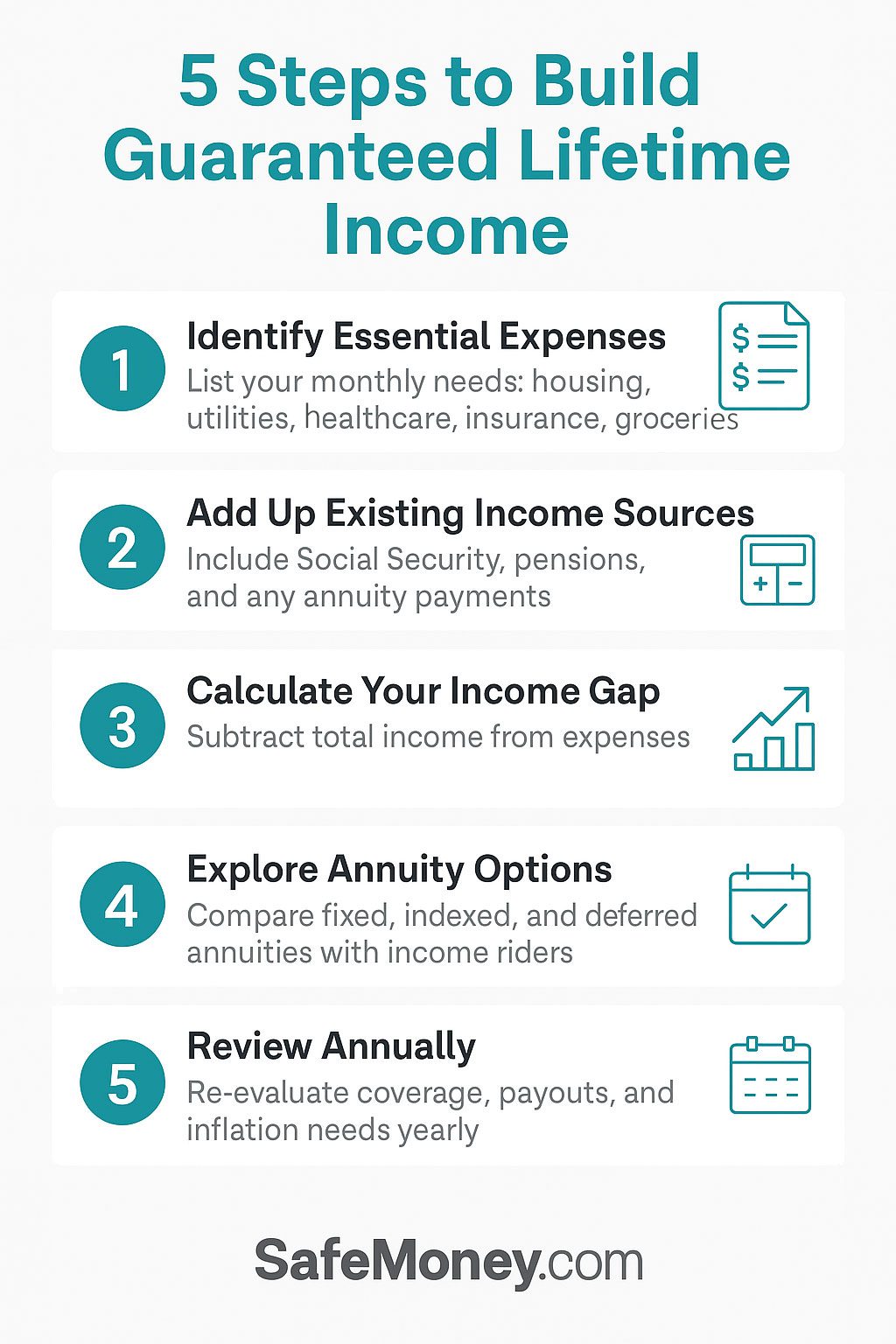

Why Guaranteed Lifetime Income Is Your Next Big Priority

The Shift: From Saving to Creating Lifetime Income For most of your working years, retirement planning is all about saving and growing your money....

Your Year-End Financial Planning Checklist for 2026

October Wrap-Up: Planning Ahead for a Stronger 2026 As Financial Planning Awareness Month comes to a close, it’s the perfect time to take action...

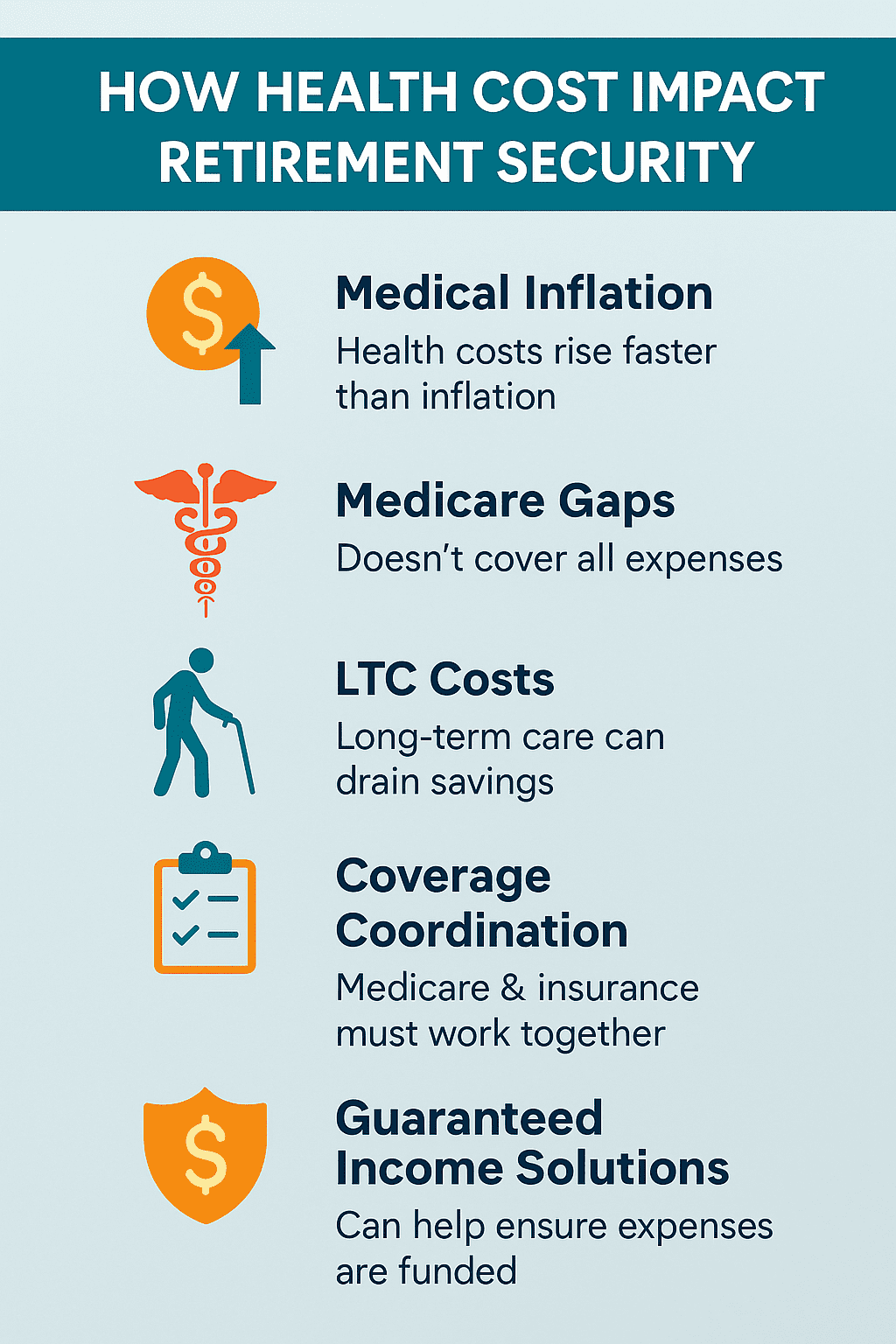

The Hidden Link Between Health Costs and Retirement Security

Why Health and Wealth Are More Connected Than Ever When planning for retirement, most people focus on saving enough money to live comfortably. But...

Tootsie Tuesday Starts Nov. 4—Stay Tuned!

A Message from Tootsie Hi there, humans! It’s me—Tootsie, your favorite English Bulldog and unofficial Chief Retirement Sniffer-Outer. I may not...

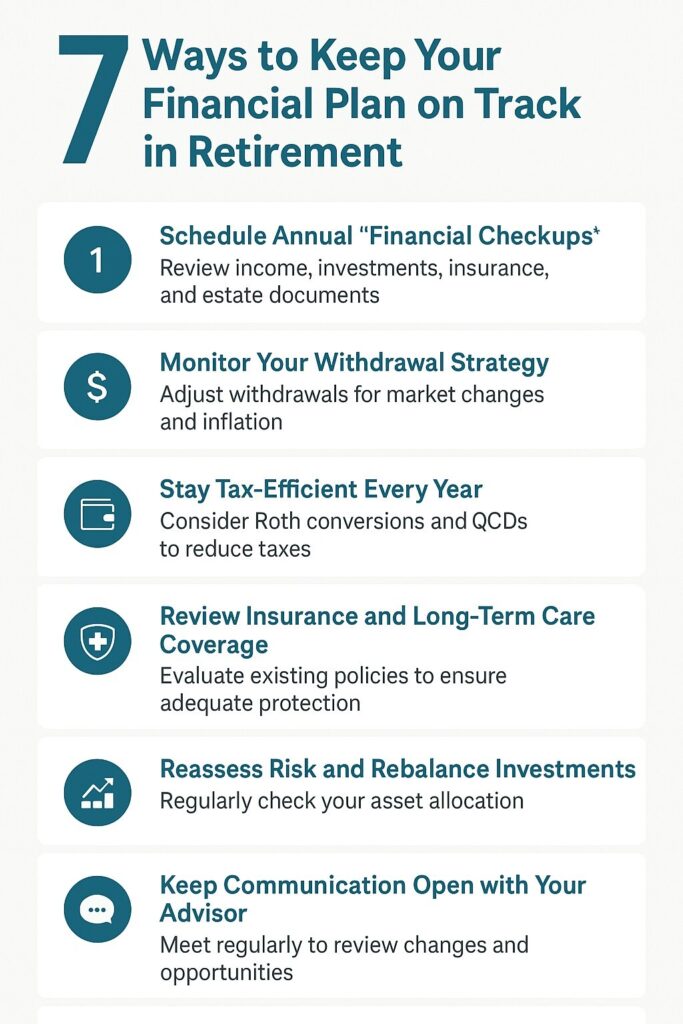

Keeping Your Financial Plan on Track After Retirement

Planning Doesn’t End When You Retire Reaching retirement doesn’t mean your financial planning journey is over—it means it’s evolving. After decades...

Medicare Open Enrollment Starts Today: What You Need to Know

October 15 to December 7: Your Window to Make Changes Today marks the start of Medicare’s Annual Election Period (AEP)—October 15 through December...

Protect What You’ve Built: Managing Risk in Retirement

You’ve Worked Hard for It—Now It’s Time to Protect It After decades of saving, investing, and preparing for retirement, the last thing you want is...

Turning Savings Into Income: Your Lifetime Paycheck Plan

From Retirement Savings to Reliable Income You’ve spent decades saving and investing for retirement. But when the paycheck stops, the real question...

The Cost of Waiting: Don’t Delay Your Financial Plan

Time Can Be Your Greatest Ally—or Your Biggest Expense When it comes to financial planning, doing nothing can be the most expensive decision of...

How to Calculate Your Retirement Income Gap (Why It Matters)

Why Retirement Income Gaps Are So Common For many retirees, the fear isn’t dying too soon—it’s living too long without enough money. Even diligent...

October Is National Financial Planning Awareness Month

Why October Matters for Your Finances Every October, National Financial Planning Awareness Month serves as a reminder to pause, reflect, and take...

The Great Wealth Transfer: Baby Boomers Passing Trillions

Over the next ten years, the United States will experience one of the largest financial shifts in history: the great wealth transfer. Baby...

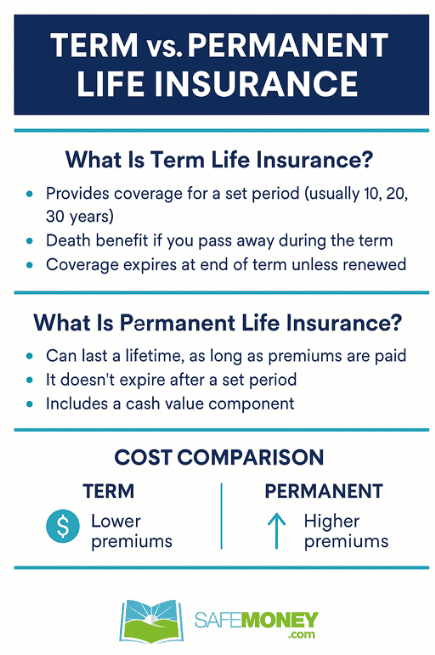

Permanent vs. Term Life Insurance: What’s the Difference?

When planning for your family’s financial future, life insurance is one of the most important tools you can put in place. But if you’ve ever...

Featured Blogs

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?