4 Retirement Myths That Can Cost You Big Time

Many retirees plan for years — only to find out some of what they “knew” about retirement wasn’t true.

The problem isn’t just misinformation; it’s that these myths can quietly drain your savings and confidence over time.

Let’s clear up four of the biggest retirement myths that could cost you if you believe them.

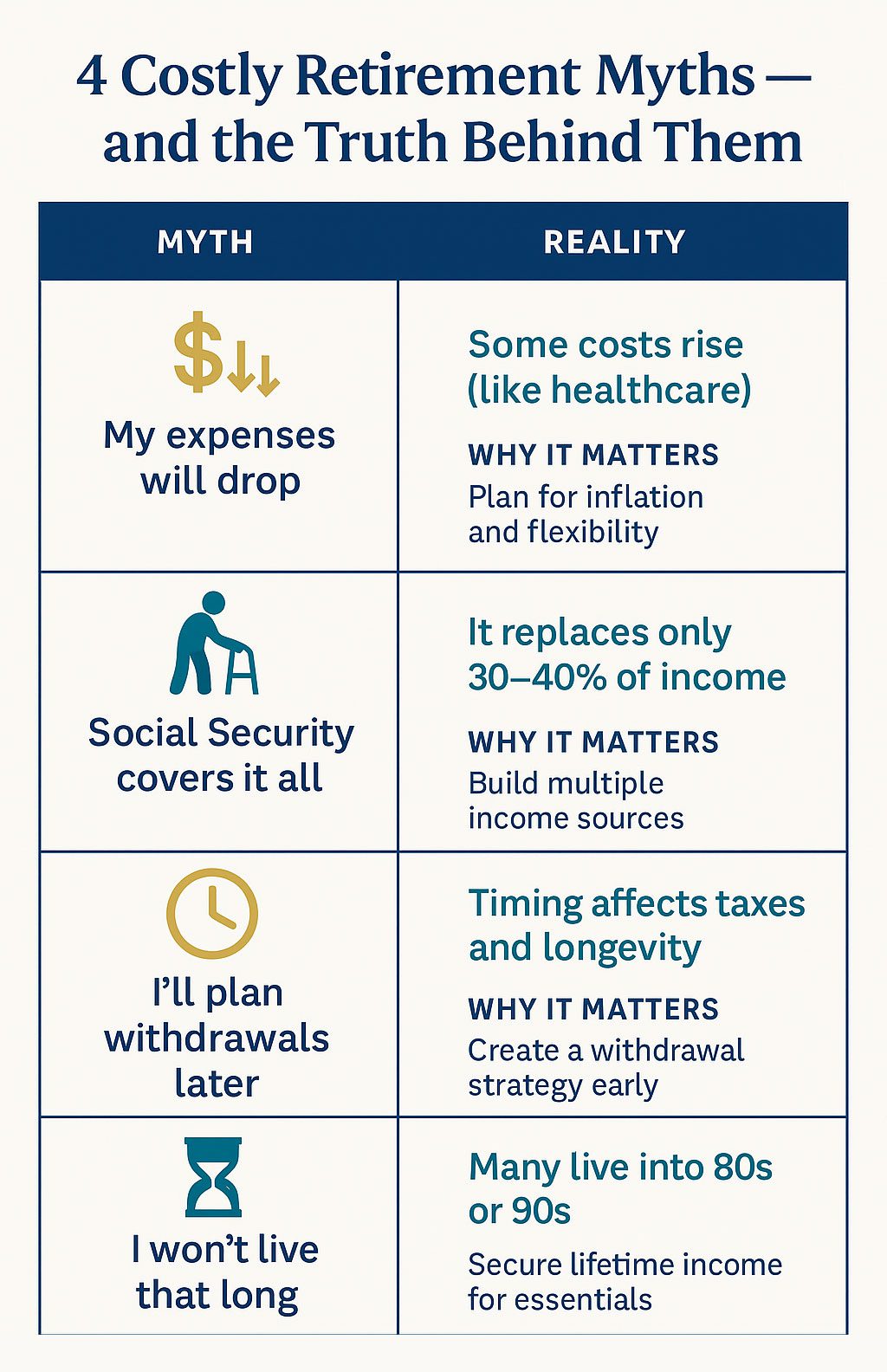

Myth #1: “My Expenses Will Drop Once I Retire.”

It’s a nice idea — but for many, it’s simply not true. While you may spend less on commuting or work clothes, other costs often rise.

Healthcare, travel, home maintenance, and inflation can all add up fast.

According to recent studies, the average couple may need over $300,000 for healthcare alone throughout retirement.

The truth:

Your spending patterns change, not just decline. It’s better to plan for level or slightly higher expenses early in retirement — and be pleasantly surprised later — than the other way around.

Smart move:

Create a flexible budget that accounts for rising costs, and review it yearly. Planning for longevity and inflation is key to avoiding shortfalls.

Myth #2: “Social Security Will Cover Most of My Income.”

Social Security helps, but it was never designed to be a full income replacement. On average, it covers only about 30%–40% of what you earned before retirement.

Relying solely on Social Security can mean tough choices later — like cutting back on essentials or dipping into savings faster than planned.

The truth:

You’ll likely need multiple income sources — including personal savings, annuities, or pensions — to maintain your lifestyle and protect against inflation.

Smart move:

Estimate your Social Security benefits at SSA.gov, then calculate your total income needs. If there’s a gap, consider guaranteed income options to supplement your base.

Myth #3: “I Can Wait Until Later to Plan My Withdrawals.”

Many retirees think they can decide where to pull income from “when the time comes.” But withdrawal sequencing — the order in which you use your assets — can make or break your retirement plan.

Taking too much from one account too soon could:

• Trigger higher taxes

• Reduce lifetime income

• Shorten how long your money lasts

The truth:

Having a tax-smart income strategy is just as important as how you invest your money. Coordinating withdrawals between IRAs, Roth IRAs, and taxable accounts can save thousands in lifetime taxes.

Smart move:

Plan withdrawals early — ideally before you retire — so you can balance income needs, minimize taxes, and extend your savings.

Myth #4: “I Won’t Live Long Enough to Worry About Running Out of Money.”

No one likes thinking about it, but longevity is one of retirement’s biggest wildcards.

Life expectancy has increased dramatically, and it’s not uncommon for retirees to live well into their 80s or 90s.

If your plan only covers 15 or 20 years, you could easily outlive your savings — especially if markets fluctuate or inflation rises.

The truth:

It’s not just about how much you have saved — it’s about how long that money will last.

A sustainable income plan should include guaranteed income sources to help cover basic needs no matter how long you live.

Smart move:

Think of your essential expenses (like housing, food, and healthcare) as needing a personal pension. Then use other assets for flexibility and fun.

The Bottom Line

The Bottom Line

Retirement isn’t the end of financial planning — it’s a new beginning.

The biggest danger isn’t market volatility or tax changes — it’s acting on assumptions that aren’t true.

By challenging these myths and updating your plan regularly, you can protect your peace of mind and enjoy a more secure, confident retirement.

Tootsie’s Takeaway

Tootsie’s Takeaway

“Don’t believe everything you hear about retirement. The truth might just make your golden years a lot brighter!”

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: SafeMoney.com provides financial education only. For guidance on your specific situation, consult a licensed professional.

The post 4 Retirement Myths That Can Cost You Big Time first appeared on SafeMoney.com.

Featured Blogs

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?