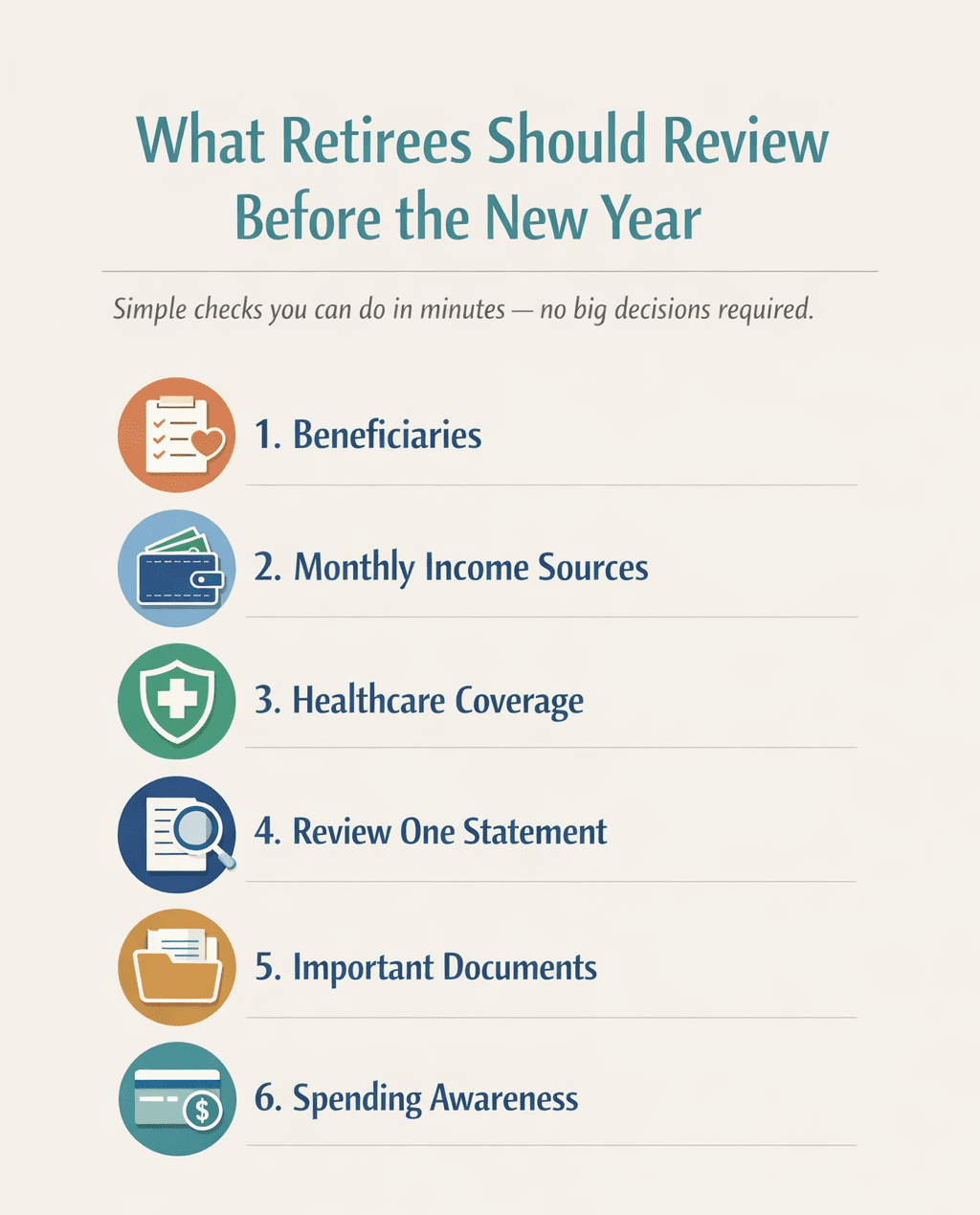

What Retirees Should Review Before the New Year

As the calendar turns toward a new year, many retirees feel a quiet pressure to “get everything in order.” Headlines talk about market shifts, policy changes, and financial strategies — but most retirees aren’t looking to overhaul their lives in December or January.

What they are looking for is clarity.

This article isn’t about making big changes, optimizing every dollar, or reworking your entire retirement plan. It’s about taking a short pause, reviewing a few important areas, and starting the year feeling more confident and less uncertain.

The good news? These reviews are simple, realistic, and can be done without stress or complex decisions.

1. Review Your Beneficiaries (You Don’t Have to Change Them)

One of the most important reviews is also one of the easiest.

Take 10 minutes to confirm the beneficiaries listed on:

- Retirement accounts

- Life insurance policies

- Bank or brokerage accounts with beneficiary designations

You are not required to make changes. The goal is simply to ensure:

- Names are spelled correctly

- The people listed are still the people you intend

- Outdated situations aren’t lingering

This small review can prevent confusion and unintended outcomes later.

2. Confirm Where Your Monthly Income Comes From

This step is about awareness, not analysis.

Write down a simple answer to one question:

Where does my money come from each month?

This might include Social Security, pensions, retirement account withdrawals, or other income sources. You’re not checking amounts or performance — just confirming:

- Income is arriving as expected

- Deposits are landing in the correct accounts

- Nothing feels unclear or uncertain

Clarity builds confidence.

3. Check Your Healthcare Coverage for the Year Ahead

Healthcare uncertainty is one of the biggest sources of stress for retirees.

Before the new year:

- Confirm your coverage is active

- Make sure your cards and policy information are current

- Know where your healthcare documents are stored

This is not about changing plans. It’s about knowing what coverage you have and how to access it when needed.

4. Review One Statement — Just One

You don’t need to review every account.

Choose one:

- A bank statement

- A retirement account summary

- An insurance policy overview

Ask yourself:

- Do I recognize this account?

- Does anything surprise me?

- Do I know who to call with questions?

Often, this simple review highlights clarity gaps — not problems.

5. Confirm Important Documents Exist and Are Accessible

You don’t need to update legal documents every year, but you should know:

- That they exist

- Where they are kept

- Who can access them if needed

This includes wills, powers of attorney, healthcare directives, and trusts. If you can confidently answer those questions, you’ve done enough for now.

6. Review Spending Awareness (Not a Budget)

This is not about tracking every dollar or cutting back.

Simply reflect on:

- What expenses caused stress this year

- Whether there were unexpected costs

- Whether your monthly spending feels manageable

Awareness alone can reduce anxiety and help guide future conversations.

7. Write Down Three Simple Answers

On a piece of paper, answer:

- Who do I call if something goes wrong financially?

- Where does my money come from each month?

- What caused the most stress this year?

No math. No spreadsheets. Just clear answers.

Starting the New Year With Confidence

You don’t need a new strategy to start the year well.

You need clarity, accessibility, and confidence in your plan’s structure. These small reviews help reduce uncertainty and create peace of mind — without pressure or overwhelm.

That’s what good retirement planning should feel like.

Tootsie’s Takeaway

Tootsie’s Takeaway

I once spent ten minutes chasing my tail before realizing it was still attached.

That’s what this review process is like — you’re not fixing anything, just making sure everything’s still where it should be.

A quick check now can save a lot of unnecessary circling later.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This article is for educational purposes only and should not be considered financial, legal, or tax advice. Individual situations vary, and readers should consult a qualified professional before making decisions.

The post What Retirees Should Review Before the New Year first appeared on SafeMoney.com.

Featured Blogs

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?