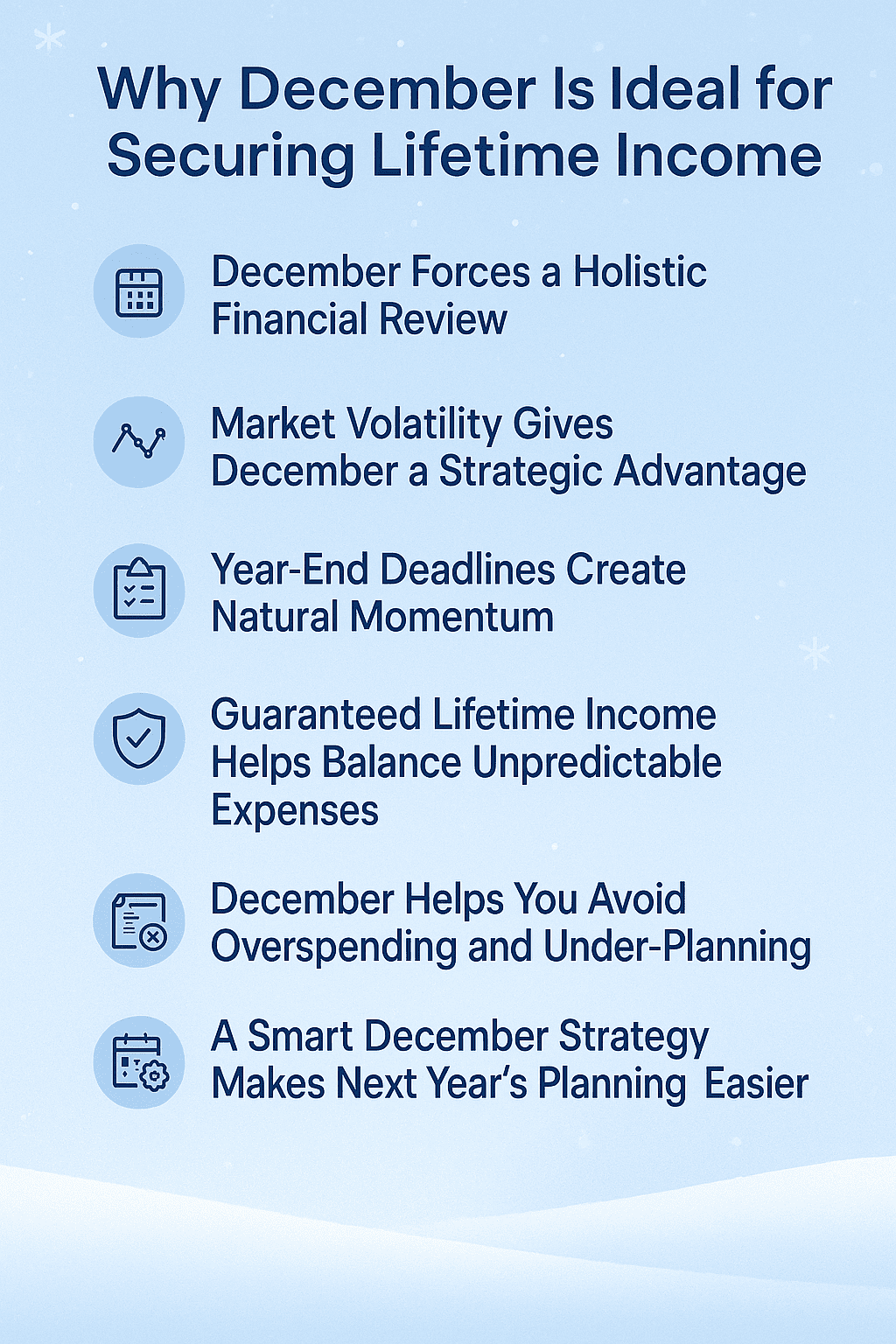

Why December Is Ideal for Securing Lifetime Income

Why December Is Ideal for Securing Lifetime Income

As the year winds down, most people turn their attention to holiday plans, family travel, and tying up loose ends before January arrives. But for retirees—and anyone within 10 years of retirement—December is one of the strongest strategic windows to secure guaranteed lifetime income.

Between year-end financial reviews, tax deadlines, Medicare updates, and market volatility, December naturally brings together the information you need to make smarter, more confident decisions about your long-term income strategy. Whether you’re exploring annuities, adjusting your withdrawal plan, or evaluating how much of your retirement income should be guaranteed, this month offers unmatched clarity.

Below, we break down why December is so valuable for lifetime income planning and the exact steps retirees should take before Jan 1.

1. December Forces a Holistic Financial Review

Most retirees already conduct a year-end checkup—tax documents, RMDs, Medicare updates, charitable contributions, and investment reviews. That means you already have the financial information needed to reassess your income strategy.

In particular, December helps retirees clearly evaluate:

- Spending vs. income gaps

- How market volatility has affected retirement assets

- Whether current income sources (Social Security, pensions, withdrawals) are predictable enough

- If guaranteed lifetime income could improve year-to-year stability

Since all your numbers are already in front of you, this month makes it obvious whether your income plan can survive inflation, longevity, and unexpected financial shocks.

2. Market Volatility Gives December a Strategic Advantage

December is historically unpredictable in the markets—sometimes strong, sometimes choppy. But for retirees, that volatility provides a unique planning opportunity.

Why?

Because volatility highlights:

- Whether your portfolio is too exposed to market swings

- If your withdrawal rate still feels comfortable

- Whether you need a stronger “safety floor” of guaranteed income

Instead of reacting emotionally to year-end swings, many retirees use December to lock in guarantees that won’t rise or fall based on next year’s markets.

3. Year-End Deadlines Create Natural Momentum

The psychology of the calendar matters. December is the final chance to:

- Fix withdrawal mistakes

- Reposition assets in a tax-efficient way

- Reduce next year’s risks

- Set a dependable income baseline for 2026 and beyond

Retirees often say that without a deadline, they put off essential planning steps. December removes that barrier. It’s now or later—and “later” often means missing opportunities.

4. Guaranteed Lifetime Income Helps Balance Unpredictable Expenses

Healthcare, inflation, and long-term care costs don’t follow a predictable schedule. By securing guaranteed income before January, retirees gain:

- Stable monthly cash flow

- Protection against outliving savings

- Reduced reliance on market withdrawals

- Peace of mind heading into the new year

Guaranteed income sources—such as fixed annuities or income riders—act as the foundation. Your investments can then grow without needing to bear all the pressure of funding everyday expenses.

5. December Helps You Avoid Overspending and Under-Planning

Holiday spending can hide problems in a retirement plan. Many retirees don’t realize how much December shopping, travel, and gifting can trim their savings.

Evaluating your lifetime income strategy now helps you:

- See your true spending habits

- Lock in predictable income before lifestyle creep becomes a problem

- Start 2026 with a clear and realistic budget

Guaranteed income can also protect you from needing to withdraw extra funds during expensive months.

6. A Smart December Strategy Makes Next Year’s Planning Easier

By securing lifetime income in December, retirees start January with:

- A clearer roadmap

- Fewer financial uncertainties

- More confidence during tax season

- A stronger cash-flow foundation

- Less dependence on market timing

Retirees who wait until mid-year often end up reacting to conditions rather than proactively shaping their income strategy. December flips that dynamic—you’re in control.

What Retirees Should Review Before Securing Lifetime Income

To make the most of this month’s planning window, review:

Your risk exposure

Your risk exposure

Identify how much of your retirement income depends on market performance.

Your required withdrawals

Your required withdrawals

Understand whether RMDs or discretionary withdrawals expose you to unnecessary volatility.

Your Social Security and pension baseline

Your Social Security and pension baseline

Determine how much guaranteed income you already have, and what gap remains.

Your healthcare coverage

Your healthcare coverage

Unexpected medical costs can weaken income plans—ensure your coverage fits upcoming needs.

Your long-term goals

Your long-term goals

Income stability allows more confidence in travel, gifting, and legacy planning.

How to Explore Your Lifetime Income Options Before Jan 1

A retirement specialist can help you:

- Evaluate which type of guaranteed income fits your goals

- Compare annuity options from top-tier carriers

- Build an income plan that blends guaranteed income with market growth

- Strengthen your plan for volatility, inflation, and longevity

December is the ideal moment to get clarity—before tax season, before new expenses appear, and before another year slips by without a strong income foundation.

Tootsie Takeaway

December is when humans get stressed… but your income plan doesn’t have to! Lock in steady treats—uhh, I mean cash flow—and enjoy a calmer new year.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This content is for educational purposes only and is not intended as financial, tax, or legal advice. Always consult a licensed financial professional before making decisions about retirement planning, annuities, or income strategies.

The post Why December Is Ideal for Securing Lifetime Income first appeared on SafeMoney.com.

Featured Blogs

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- dummy blogss test

- new web blog entries

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- What Does Full Coverage Really Mean? (Spoiler: It’s Not as ‘Full’ as Most People Think)

- Kikru 2