Keeping Your Financial Plan on Track After Retirement

Planning Doesn’t End When You Retire

Reaching retirement doesn’t mean your financial planning journey is over—it means it’s evolving. After decades of saving, the challenge shifts from building wealth to preserving and managing it.

This October, during National Financial Planning Awareness Month, it’s the perfect time to make sure your plan is keeping up with your life, your goals, and the economy.

Why Ongoing Planning Matters

A financial plan isn’t a one-time document—it’s a living strategy. Life changes, markets fluctuate, tax laws evolve, and healthcare costs rise. Without regular check-ins, even a solid plan can drift off course.

Common Triggers That Require a Plan Update:

- A spouse retires or starts Social Security

- A new grandchild or inheritance

- Health or long-term care needs change

- Market conditions shift significantly

- Major expenses arise (home repair, travel, family support)

Proactive reviews ensure your plan adapts before small issues become big problems.

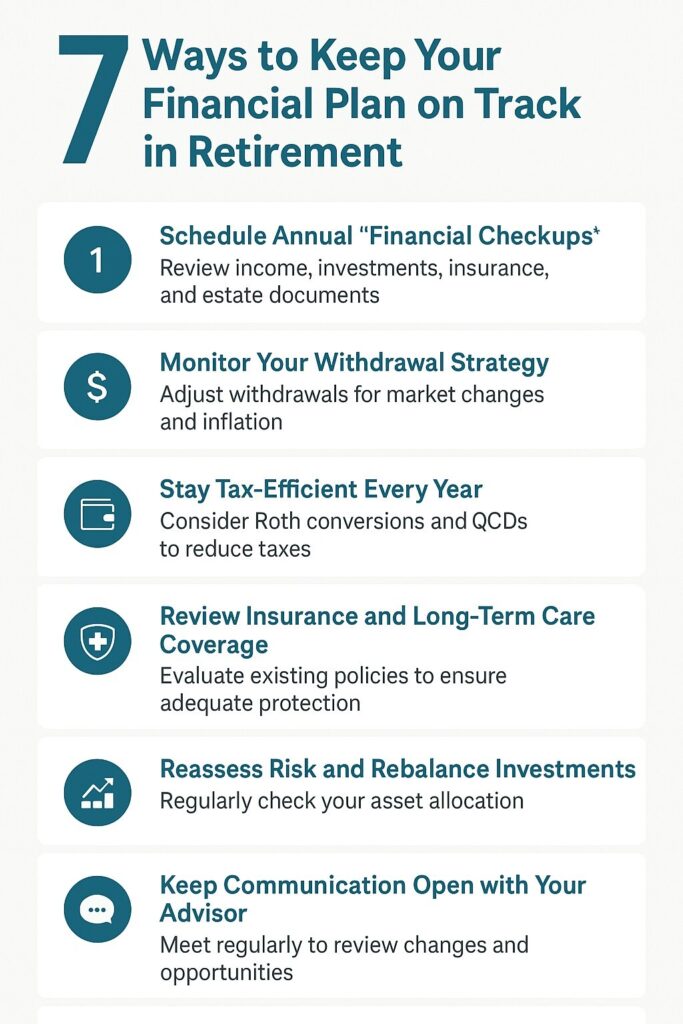

1. Schedule Annual “Financial Checkups”

Just as you visit your doctor for an annual physical, your finances deserve the same attention.

An annual review should include:

- Income vs. Expenses: Are your withdrawals sustainable?

- Investment Performance: Are your allocations still appropriate for your age and risk tolerance?

- Insurance Coverage: Is your life or long-term care insurance still adequate?

- Tax Strategy: Are you taking advantage of deductions, Roth conversions, or charitable giving opportunities?

- Estate Documents: Have you updated beneficiaries or powers of attorney recently?

A yearly checkup keeps your plan healthy and your confidence strong.

2. Monitor Your Withdrawal Strategy

Retirement income planning is not “set it and forget it.” Economic conditions can change quickly—so should your withdrawal strategy.

Key Considerations:

- Market downturns: Reducing withdrawals temporarily can help preserve principal.

- Inflation spikes: You may need to increase withdrawals or rebalance investments to maintain purchasing power.

- Health events: Unexpected costs may require reallocating assets or triggering an annuity income rider.

The goal: Maintain flexibility so your income lasts no matter what happens.

3. Stay Tax-Efficient Every Year

Taxes don’t stop at retirement. Withdrawals, Social Security, and RMDs (Required Minimum Distributions) can push you into higher brackets unexpectedly.

Tips to Stay Ahead:

- Convert to a Roth IRA in lower-income years.

- Coordinate withdrawals between taxable, tax-deferred, and tax-free accounts.

- Use Qualified Charitable Distributions (QCDs) after age 70½ to satisfy RMDs tax-free.

Even modest tax adjustments can preserve thousands in lifetime income.

4. Review Insurance and Long-Term Care Coverage

As health needs evolve, so should your coverage.

- Life Insurance: Does your policy still match your family’s needs or estate plan?

- Long-Term Care Riders: Review the income multipliers and coverage options on annuities or life policies.

- Medicare: Reevaluate plans during open enrollment each fall to ensure they fit your prescriptions and providers.

Health changes can happen quickly—staying proactive keeps your financial plan resilient.

5. Reassess Risk and Rebalance Investments

Over time, market movements can skew your investment mix. A portfolio meant to be “balanced” can become too aggressive—or too conservative—without regular rebalancing.

Checklist for Annual Review:

- Revisit your risk tolerance.

- Evaluate guaranteed vs. variable income sources.

- Adjust allocations based on age, goals, and current market trends.

By maintaining the right balance between safety and growth, you can preserve stability while still keeping pace with inflation.

6. Keep Communication Open with Your Advisor

One of the biggest mistakes retirees make is assuming their advisor will automatically reach out if something needs to change. But financial planning is a partnership—it works best when both sides stay engaged.

Set recurring appointments (at least annually) to:

- Review progress toward your goals.

- Discuss any changes in income needs or family dynamics.

- Explore new opportunities for protection, tax efficiency, or growth.

If your advisor doesn’t encourage ongoing communication, it may be time to seek one who does.

7. Prepare for the Unexpected

Even the best plans face surprises: economic downturns, healthcare costs, or family emergencies. Protecting yourself starts with:

- An emergency fund equal to 6–12 months of expenses.

- Guaranteed income sources for essentials.

- Estate planning documents that are always up to date.

A resilient plan doesn’t eliminate uncertainty—it absorbs it.

A Retirement Plan That Evolves With You

Retirement success isn’t defined by a single decision or product—it’s defined by consistency. The best financial plans evolve with your life, adapt to changes, and give you peace of mind every step of the way.

This Financial Planning Awareness Month, take time to:

Schedule your annual review.

Schedule your annual review.

Reevaluate your income and tax strategies.

Reevaluate your income and tax strategies.

Ensure your plan is ready for the years ahead.

Ensure your plan is ready for the years ahead.

Because true financial confidence doesn’t come from having a plan—it comes from keeping it on track.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This article is for informational and educational purposes only and should not be construed as financial, legal, or tax advice. Consult a licensed financial professional regarding your individual situation. SafeMoney.com is not affiliated with or endorsed by any government agency.

The post Keeping Your Financial Plan on Track After Retirement first appeared on SafeMoney.com.

Featured Blogs

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- dummy blogss test

- new web blog entries

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- What Does Full Coverage Really Mean? (Spoiler: It’s Not as ‘Full’ as Most People Think)

- Kikru 2